|

Forbes accused of selling MFA media to brands under guise of legitimate ad space

Source: The Drum

April 4th, 2024

source: Adalytics

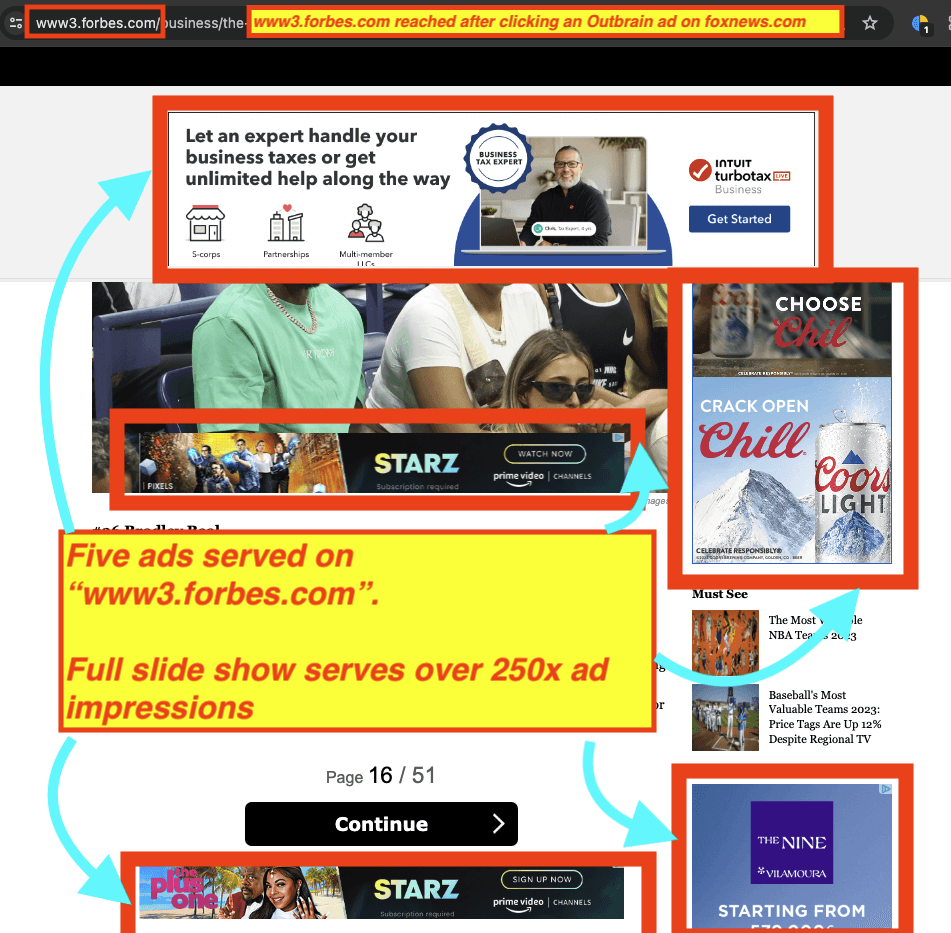

Summary: Adalytics has struck again with another report illuminating shady digital advertising practices. This time, the publisher Forbes is in the hot seat for running a secret made-for-advertising (MFA) subdomain (www3.forbes.com) that served ads which brands thought would be running on Forbes' flagship website. Forbes repurposed articles for the subdomain and showed as many as 200 ads during a single page view, compared to three to 10 ads for an article on Forbes.com. The subdomain lacked subscription paywalls and wasn't accessible through organic search because it didn't allow search engine crawlers to index its articles. Since 2017, hundreds of brands and agencies have purchased media on www3.forbes.com, including Microsoft, Disney, JPMorgan Chase, Omnicom Media Group, Havas, and Horizon Media. And major DSPs and SSPs have monetized the domain. Forbes shut down the site after the Wall Street Journal started sniffing around.

Forbes told AdExchanger that the subdomain was “an insignificant part of [its] business,” representing “about 1% of Forbes’ overall user base.”

Opinion: This isn't too surprising coming from Forbes, as it has always had a bit of a reputation issue:

Regardless, this is the kind of stuff that gives the entire industry a black eye and reinforces our worst stereotypes. We are once again reminded that no one is incentivized to move on from this crap: not ad tech companies, not advertisers, not verification companies, not publishers. So it will continue, until the incentives change. Who knows when (if) that will happen.

On one hand, we get it; being a publisher is not easy right now and it’s only getting harder. On the other hand, this cannot be the answer. If anything, premium publishers should be running hard at becoming even “more premium” right now by gating their data and taking control of their supply (see: Disney). Especially as signal loss hits ad tech intermediaries hard and marketers have a need to get closer to consumers.

Publishers have an opportunity to rise back to the top of the advertising food chain. But they must be strategic and think long-term, not get sucked into the dark arts of the ad tech industrial complex in order to make a quick buck.

|

|

|

Other Notable Headlines

Chase pioneers targeted in-app advertising with banking customer data - JPMorgan Chase has launched Chase Media Solutions to connect retailers to its 80M customers. The bank will use its extensive first-party data to help retailers target offers and discounts to its users. Chase banking app users will see the targeted offers based on their spending data when they log in; if users make a purchase, Chase will charge the retailer for the ad. The program could turn Chase's app into a super-app that enables users to access all kinds of non-financial services from a single platform, while also creating a multibillion-dollar revenue stream from ads. JPMorgan Chase is the No. 1 bank in the US by assets. Is this the first finance media network?!

It’s Time for Publishers and Advertisers to Get to Grips with Tech Lab’s New Video Ad Definitions - The IAB Tech Lab released updated standardized definitions last year to label video inventory appropriately. The guidelines are meant to give buyers more transparency between instream and outstream ads, which weren't always labeled correctly under the old definitions. Previously, sellers often labeled "accompanying content" (e.g., when an article is combined with stock video or images to generate video ad inventory) as instream video. In reality, many advertisers consider instream to be high-quality ads that play within a content player and accompanying content to be more like outstream, which tends to be lower quality. Google adopted the new definitions on April 1st, which means that a lot of inventory previously classified as instream will now be outstream and garner lower CPMs.

Exclusive: Google parent Alphabet weighs offer for HubSpot - A Hubspot deal would strengthen Google's position in the CRM space, which is mostly dominated by Salesforce, followed by SAP, Microsoft, and Oracle. It would also help Google in the cloud computing race. HubSpot is valued at around $35B, with $2.2B in 2023 revenue but a net loss of $176.3M. This would be Alphabet's biggest acquisition ever if it ends up happening. It’s working with Morgan Stanley to think through the details. Given all of the antitrust pressure Google is facing right now, we’d be surprised if a deal actually materializes and even more surprised if it gets past regulatory scrutiny.

Snowflake and Snap partner to integrate clean rooms with conversions API 🔒 - The integration makes it easier for advertisers to access, manage, and share their data securely into Snap’s ecosystem. Through a separate partnership with AppsFlyer, Snap aims to drive better mobile measurement, which has already resulted in a 158% increase in Snap iOS conversions and 41% decrease in cost-per-app-install, according to AppsFlyer.

“Snowflake’s made all these investments to get their infrastructure embedded into digital marketing departments,” U of Digital’s Myles Younger told Digiday. “At least for Snowflake’s client base, all those customer emails are already sitting in Snowflake like they’re already there. And so the more closely Snap and Snowflake can integrate between one another, the less work the advertiser has to do.”

Instagram makes more money from ads than YouTube does, and it has for years - Meta doesn't break out Instagram's ad revenue, but a recent court filing sheds light on its lucrative business unit. Instagram raked in $32.4B in 2021 ad revenue, compared to $28.8B for Alphabet's YouTube. Not that YouTube is a slouch—an analyst recently pegged its value at $400B as a standalone company, which isn't bad considering that Google only paid $1.65B for the video platform in 2006. Meta revealed Instagram's revenue figures as part of its effort to get an FTC antitrust lawsuit dismissed.

The JIC Certifies Comscore And VideoAmp As National TV Currencies - The certifications for Comscore and VideoAmp come just before upfront negotiations in May. Comscore, VideoAmp, and iSpot all received conditional certifications in September. Comscore and VideoAmp have now received full JIC certification, but iSpot isn't applying for full certification until June because it is still integrating its 605 acquisition. The incumbent Nielsen isn't participating in the JIC but plans to start recommending that buyers move from its panel-only product in September to its combined currency, which is based on both panels and TV viewing data sets.

LinkedIn Teams With NBCU For B2B CTV - The company's new LinkedIn CTV Ads solutions will let advertisers use LinkedIn's Campaign Manager to run CTV campaigns that can be extended across Paramount, Roku, Samsung, and other publishers within its network. LinkedIn has partnered with NBCUniversal on a managed service offering called LinkedIn Premiere to target B2B decision-makers across NBCU's streaming content. LinkedIn will be utilizing iSpot for advanced audience measurement and Kantar for brand lift studies. Another new LinkedIn product, Live Event Ads, will help companies drive event registrations and brand awareness. LinkedIn says the number of users viewing events on its platform has grown 34% in the last year.

For the New York Times, attention metrics find new applications - Attention metrics leader Adelaide will onboard The New York Times as its first customer on its Adelaide for Publishers platform. Attention metrics are becoming increasingly popular as a way to measure ad impact by gauging how much attention users pay to ads. The Times has been using its own attention metric since last year, but it hopes to use Adelaide's metrics to connect attention to advertisers' campaign performance in order to demonstrate the value of its ads.

New Privacy Bill Would Restrict Behavioral Advertising - US lawmakers are taking another swing at a federal privacy law that would tighten data privacy rules, promote data minimization, and limit targeted advertising. The bi-partisan bill, called the American Privacy Rights Act of 2024, would give consumers more control over their online advertising experiences If passed, the law would supersede the patchwork of proliferating state-level privacy laws.

PubMatic and Instacart join forces to marry retail media data with programmatic advertising - Independent supply side platform (SSP) PubMatic will use Instacart's first-party shopper data to identify the best inventory to find Instacart audiences from nearly 1,800 publishers in its network. Brands will be able to utilize the data for targeting and measurement within PubMatic’s Convert platform. Initial participating buyers include GroupM and Mars. Once again, an SSP is cutting out DSPs by offering a unique solution directly to advertisers. In this case, it's Instacart's differentiated commerce media data. Whenever there’s an opportunity to offer unique, premium inventory and / or data, you can expect SSPs and DSPs to pounce on it and try to cut the other one out. The SSP-DSP wars continue…

Innovid Wants To Create Harmony Within The CTV Supply Chain - Ad servers want a piece of the action, too. Innovid's new supply-path optimization product connects advertiser and publisher ad servers to automate the workflow of publisher-direct CTV buys. Harmony Direct essentially functions like a direct transaction between an advertiser and a publisher, letting the advertiser create a programmatic guaranteed or private marketplace deal directly with a publisher and then track and optimize the deal without a DSP through Innovid's integrations with the publisher’s ad server. Since it's not technically part of any media transaction, Innovid says it’s not trying to cut out DSPs or SSPs...

|

|

|

Other Notable Headlines (That You Should Know About Too)

Flip: Social Commerce Company Raises $144 Million At $1.05 Billion Valuation - AppLovin invested $50M in Flip and will offer its AXON technology to Flip brands.

ID5 Closes $20M Series B Funding, Expands Identity Focus - Investors include TransUnion and Sir Martin Sorrell’s S4S Ventures, bringing the identity company's total funding to $27M.

Privacy-preserving data sharing now generally available with BigQuery data clean rooms - BigQuery is Google’s serverless data warehouse platform. It now has a data clean room offering.

Meta (again) denies that Netflix read users’ private Facebook messages - The allegations surfaced in a class-action data privacy lawsuit against Meta.

AMC Networks Preaching “Flexibility” As It Expands Digital Offerings for 2024 Upfront - AMC is adding ad-supported tiers to its niche streaming services such as Shudder and Acorn TV.

Spotify's Plan to Monetize Live Events 🔒 - Its Live Experiences product could add more touchpoints to its ads business.

Samba TV Launches Near Real-Time Political Platform - Political advertisers will be able to leverage next-day ad targeting at the regional, state, and national levels. Yahoo and TelevisaUnivision are two early partners.

Roku’s idea of showing ads on your HDMI inputs seems like an inevitable hell - A Roku patent could theoretically enable Roku TVs to show ads when tuned to an HDMI input that is paused. Have we gone overboard?

|

|

|

That's it for this week's newsletter. Drop us a line with any questions / feedback.

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team? Let's talk.

Thanks for reading!

|

|

|

|